Payroll

Definitions

enableHR Employee records are enhanced with Payroll related fields.

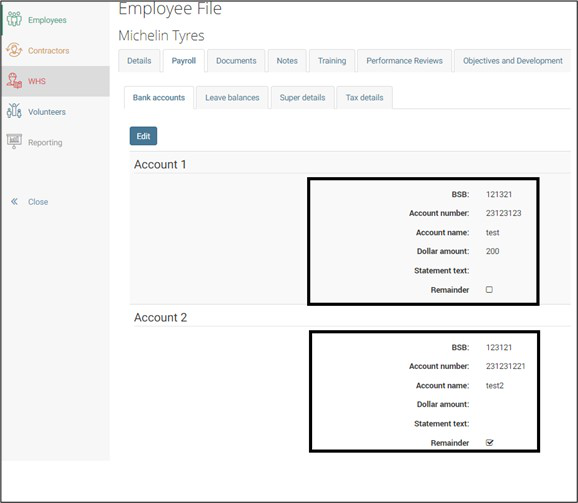

For Australian accounts:

- Bank Accounts:

- Up to 4 bank accounts are supported. The order in which accounts are to be considered (by the payroll system) is mandatory.

- A Bank Account is made of a BSB and Account number together.

- Each bank account has a “Dollar amount” that represents the $ figure that the payroll system will use for payment into this bank account. The “Remainder” option is used for “everything left”.

- Tax:

- All the essential details needed for the Australian taxation purpose are supported, including Tax File Number, Residency Status, Employment basis, Tax free threshold, HECS and Trade Support Loan.

- TFN is masked except for the last 3 digits (###-###-123), if un-masked TFN is needed for Payroll integration purposes, please contact Client Success at support@enablehr.com.

- Superannuation: Supports industry or commercial super funds and as well Self-Managed Super Funds. Up to 4 Superannuation funds can be maintained for an employee including Fund name, Fund address, Fund ABN and USI.

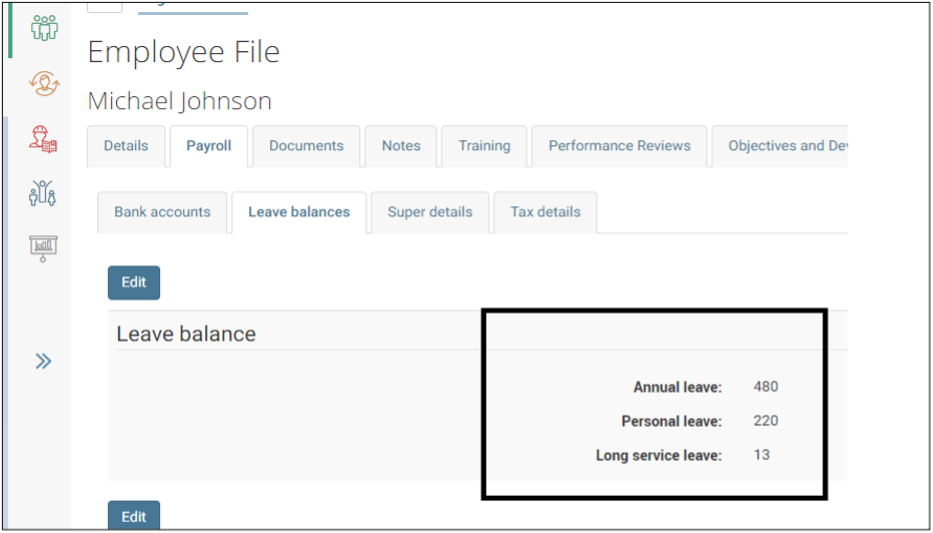

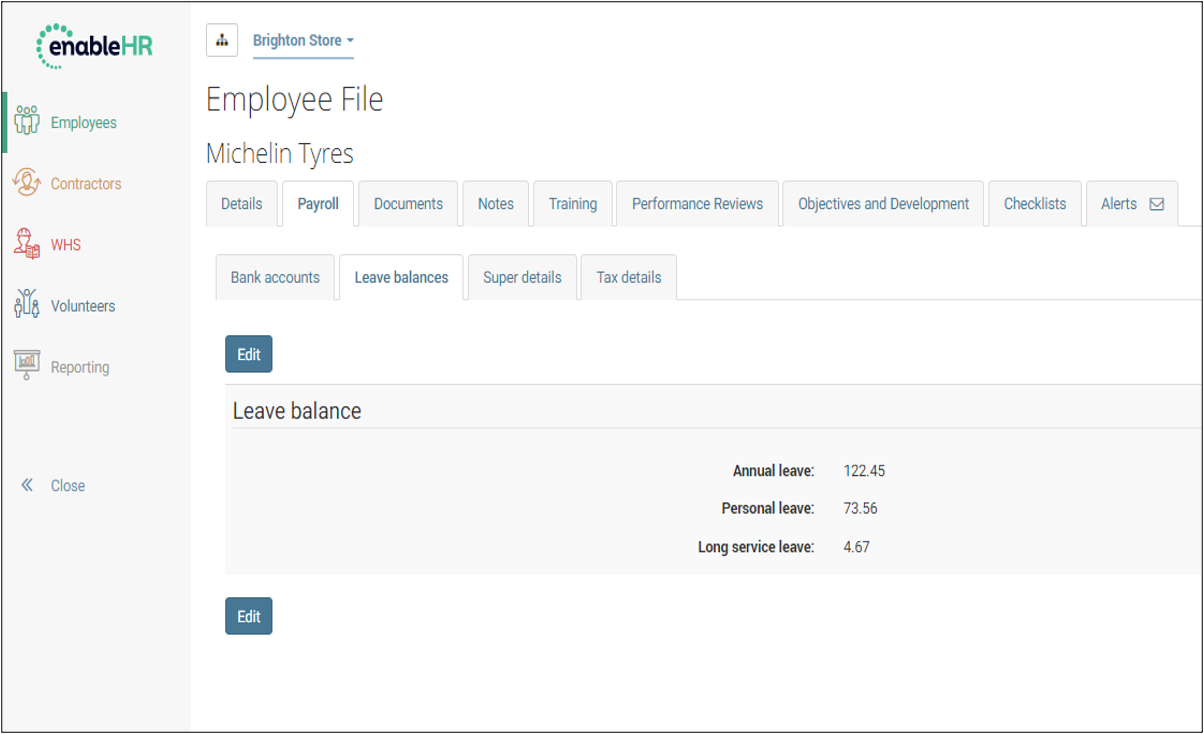

- Leave Balances: Leave balances information can be maintained for Australian employees includes Annual, Personal and Long Service leaves.

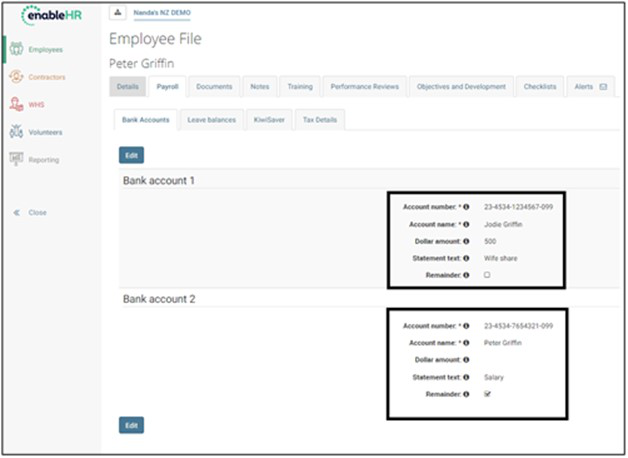

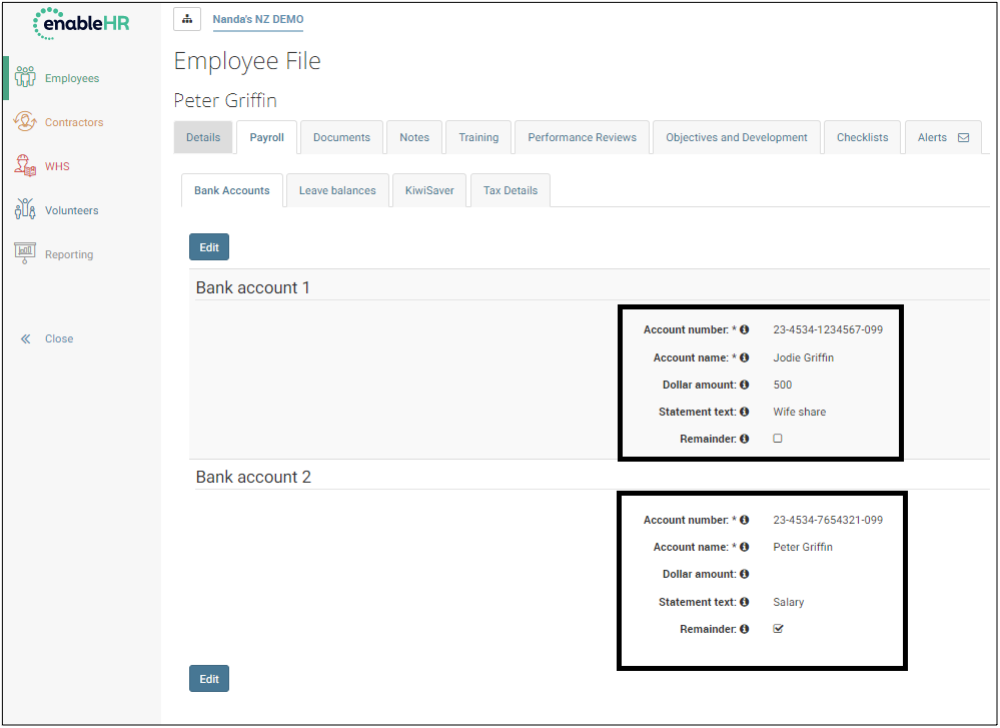

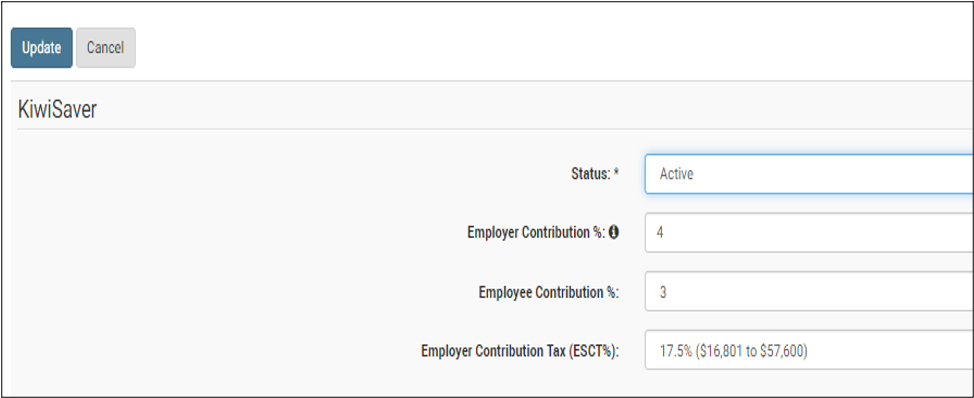

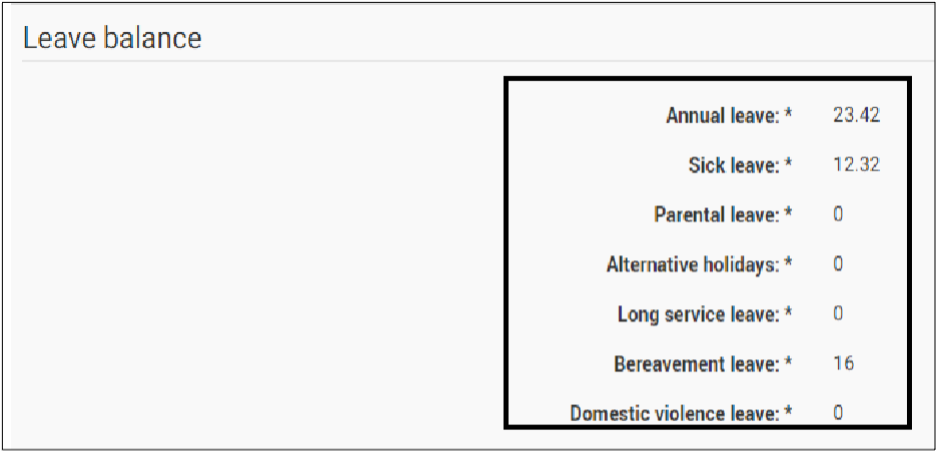

For New Zealand accounts:

- Bank Accounts:

- Up to 4 bank accounts are supported. The order in which accounts are to be considered (by the payroll system) is mandatory

- 16-digit account number which includes Bank number, Branch Number, Account number and suffixes.

- Each bank account has a “Dollar amount” that represents the $ figure that the payroll system will use for payment into this bank account. The “Remainder” option is used for “everything left”.

- Tax: Mandatory tax information including Tax Code, Student loan percentage and IRD number are maintained in enableHR.

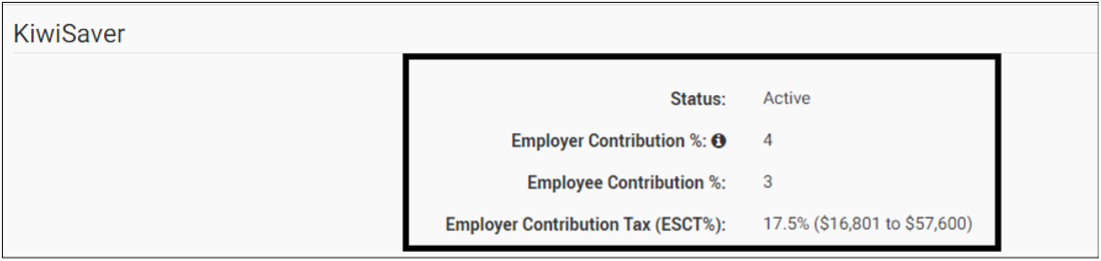

- Kiwisaver: Retirement saving information for New Zealand employees includes Employee & Employer contributions and as well as pre-defined Employer superannuation contribution tax (ESCT) are maintained.

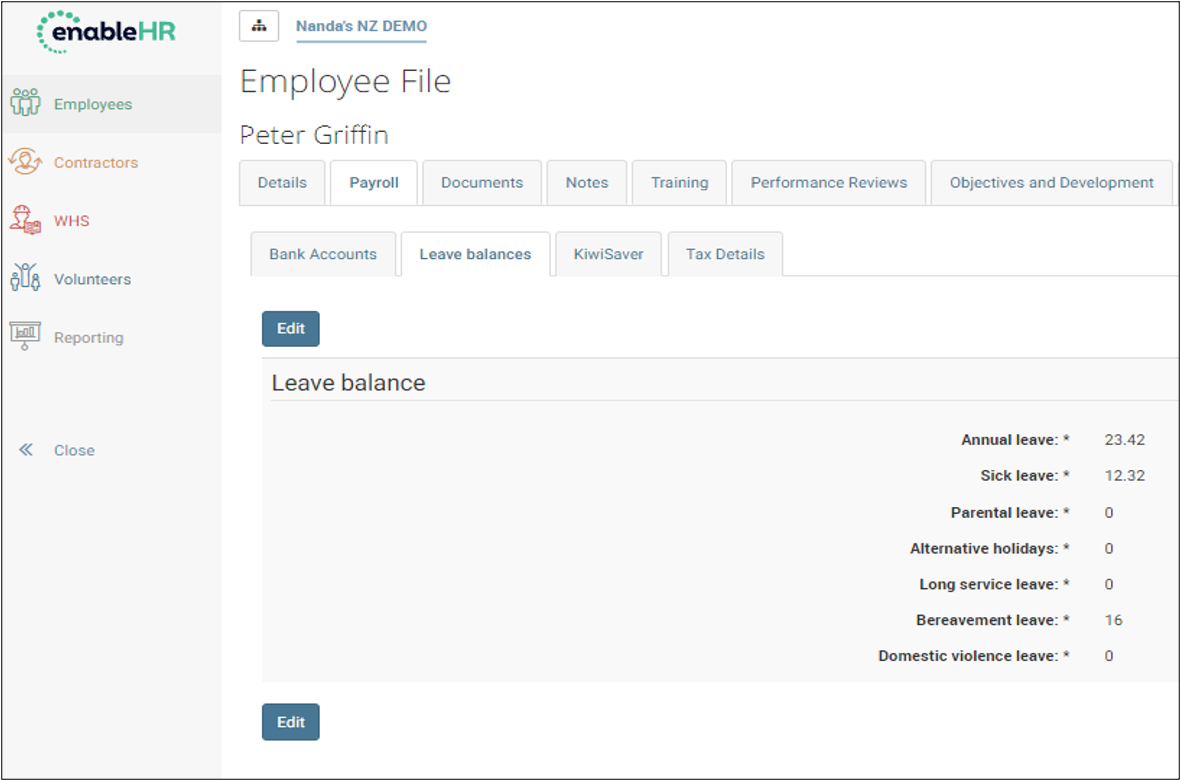

- Leave Balances: Majorly used leave balances information can be maintained for New Zealand employees includes Annual, Sick, Personal, Long Service, Bereavement and Domestic Violence leaves.

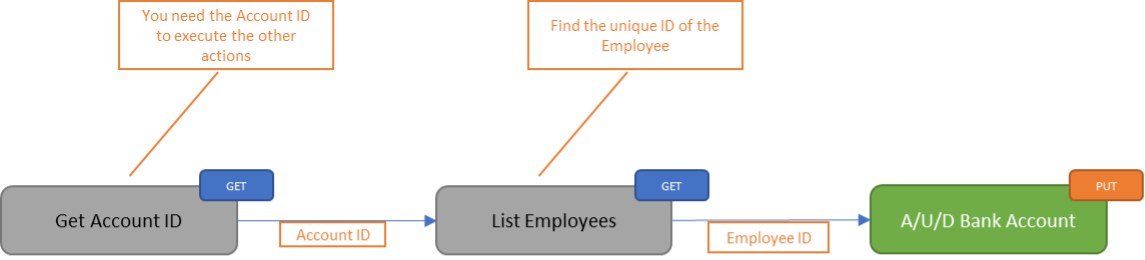

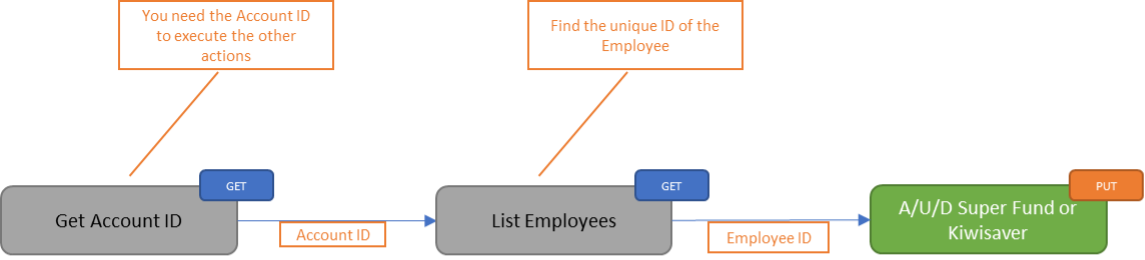

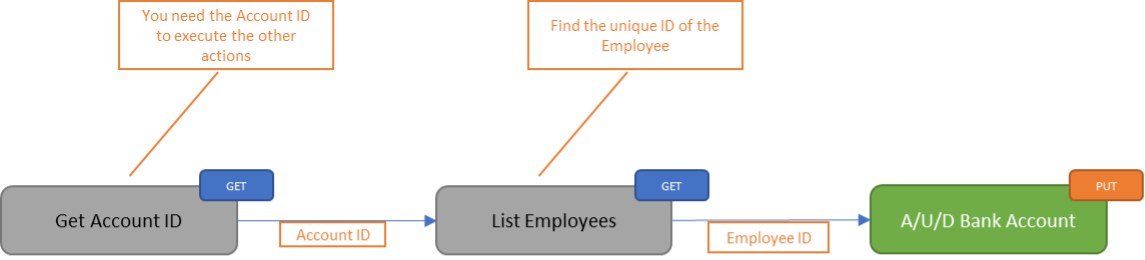

Add / Update / Delete Bank Accounts

Use this action to Add, Update or Delete employee bank details.

The same action is used to add, update and delete Bank Accounts in Australia and New Zealand. The API call knows if the Account is in Australia or New Zealand, so you don’t have to specify it.

enableHR supports up to 4 bank accounts. The order in which accounts are to be considered (by the payroll system) is mandatory.

- If the Employee doesn’t have any bank account, the ones passed through the API are added.

- If the Employee already has some bank account details, they will be updated with the new ones.

- If the API doesn’t send any bank account details, then the existing details for the Employee will be deleted.

Each bank account has a “Dollar amount” that represents the $ figure that the payroll system will use for payment into this bank account. The “Remainder” option is used for “everything left”.

| |

|---|

| Method | PUT: Maintain Employee Bank Details |

| Parameters | Account ID - Unique identifier of the Account

Employee ID - Unique identifier of the Employee |

| Accepted Parameters | | | |

|---|

| Field | Details | Example | For Australian Accounts | | | BSB - Mandatory | Bank State branch of the bank account | 094301 | Account Number - Mandatory | Bank account number of the employee | 123456789 | Account Name - Mandatory | Name of the person for the bank account | Linda Johnson | | Dollar amount | Specified amount to be deposited | If Remainder is chosen – Null value (or) the specified amount as per setup. | | Statement Text | Text that appears on bank statement | Balance Salary | Remainder - Mandatory | Identifier to decide which bank accounts gets the remaining part of the salary credit. | True / False | Account Order - Mandatory | Order of how the bank account setup is to be considered | 0 (or) 1 (or) 2 (or) 3 | | | | For New Zealand Accounts | | | Bank Account Number - Mandatory | Bank account number of the employee | 123456789 | Account Name - Mandatory | Name of the person for the bank account | Linda Johnson | | Dollar amount | Specified amount to be deposited | If Remainder is chosen – Null value (or) the specified amount as per setup. | | Statement Text | Text that appears on bank statement | Balance Salary | Remainder - Mandatory | Identifier to decide which bank accounts gets the remaining part of the salary credit. | True / False |

|

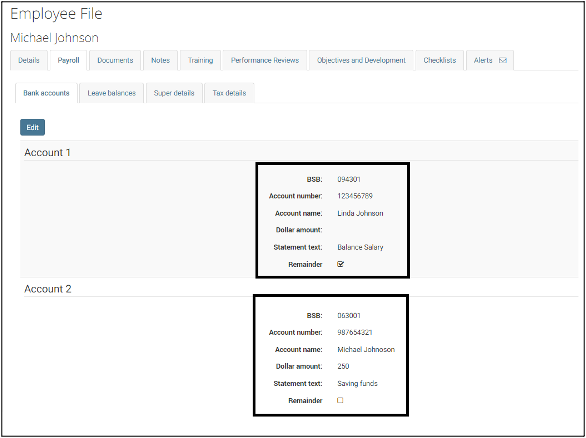

Australian Accounts

New Zealand Accounts

Retrieve Bank Accounts

Use this action to retrieve the Bank Account details of an Employee.

enableHR supports up to 4 bank accounts. The order in which accounts are to be considered (by the payroll system) is mandatory.

Each bank account has a “Dollar amount” that represents the $ figure that the payroll system will use for payment into this bank account. The “Remainder” option is used for “everything left”.

| |

|---|

| Method | GET: Retrieve Bank Details |

| Parameters | Account ID - Unique identifier of the Account

Employee ID - Unique identifier of the Employee |

| Response | | | |

|---|

| Field | Details | Example | For Australian Accounts | | | | BSB | Bank State branch of the bank account | 094301 | | Account Number | Bank account number of the employee | 123456789 | | Account Name | Name of the person for the bank account | Linda Johnson | | Dollar amount | Specified amount to be deposited | If Remainder is chosen – Null value (or) the specified amount as per setup. | | Statement Text | Text that appears on bank statement | Balance Salary | | Remainder | Identifier to decide which bank accounts gets the remaining part of the salary credit. | True / False | | Account Order | Order of how the bank account setup is to be considered | 0 (or) 1 (or) 2 (or) 3 | | | | For New Zealand Accounts | | | | Bank Account Number | Bank account number of the employee | 123456789 | | Account Name | Name of the person for the bank account | Linda Johnson | | Dollar amount | Specified amount to be deposited | If Remainder is chosen – Null value (or) the specified amount as per setup. | | Statement Text | Text that appears on bank statement | Balance Salary | | Remainder | Identifier to decide which bank accounts gets the remaining part of the salary credit. | True / False | | Account Order | Order of how the bank account setup is to be considered | 0 (or) 1 (or) 2 (or) 3 |

|

Australian Accounts

New Zealand Accounts

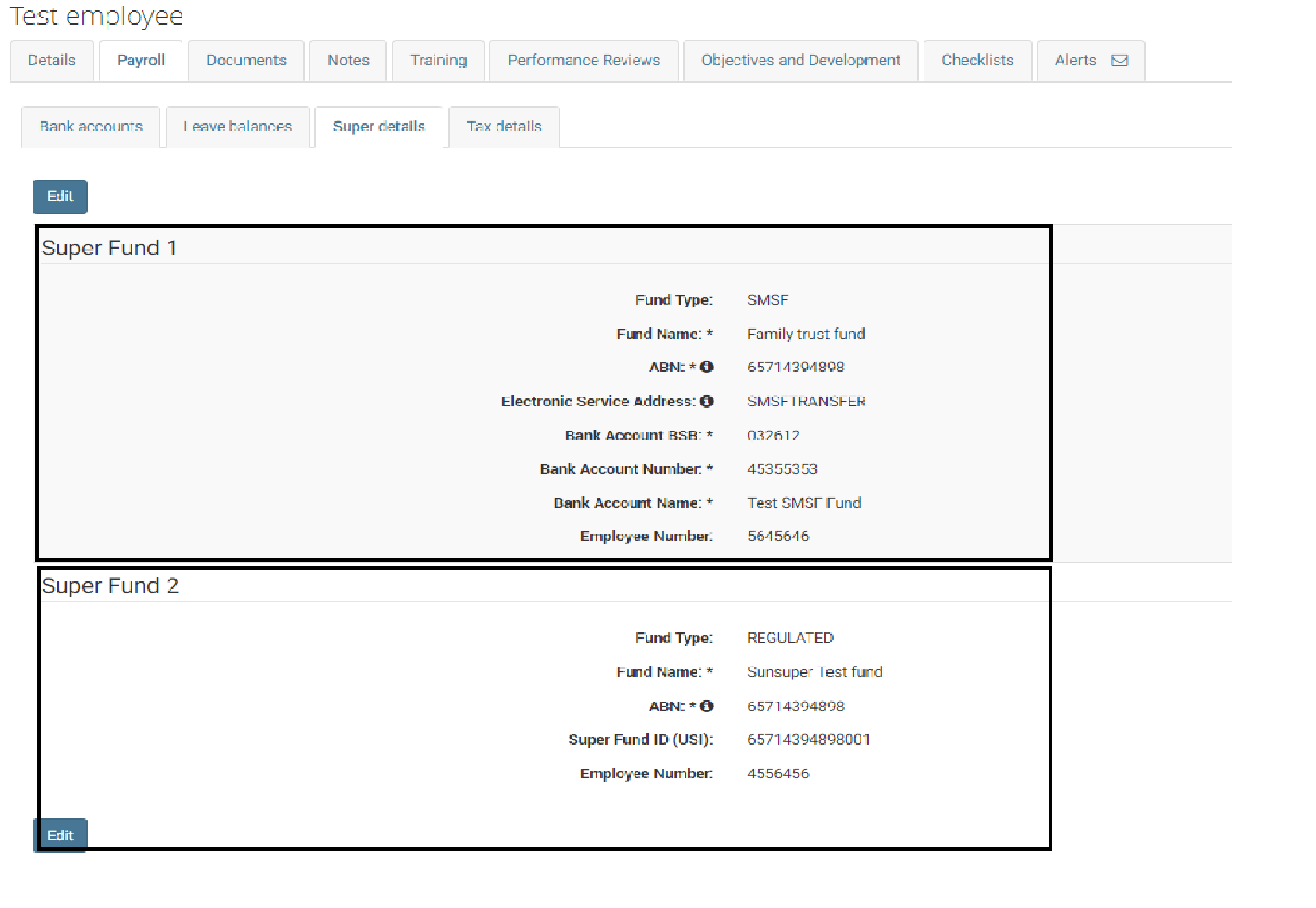

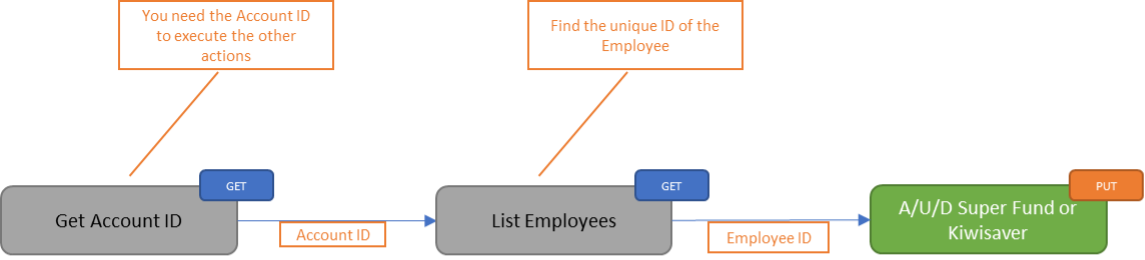

Add / Update / Delete Superannuation / Kiwisaver

Use this action to Add, Update or Delete employee Superannuation (Australia) or Kiwisaver (New Zealand) details.

The same action is used to add, update and delete Super Funds in Australia and New Zealand. The API call knows if the Account is in Australia or New Zealand, so you don’t have to specify it.

- If the Superannuation / Kiwisaver details are not already present, they will be added

- If the Superannuation / Kiwisaver details already exist, they are updated with the new details.

- When the details are empty, the input details are removed, Superannuation / Kiwisaver details for the employee will be deleted.

enableHR supports up to 4 super funds in Australia that can include either Regulated or Self-Managed Super Fund types. Multiple Superannuation records can be maintained for an employee including Fund name, Fund address, Fund ABN and USI.

| |

|---|

| Method | PUT: Maintain Employee Retirement Saving Details |

| Parameters | Account ID - Unique identifier of the Account

Employee ID - Unique identifier of the Employee |

| Accepted Fields | | | |

|---|

| Field | Details | Example | For Australian Accounts | | | | Regulated | | | Type - Mandatory | Type of SuperFund | Accepted values: REGULATED | | Employee/member number | Unique Member number for the super fund | 98001 | Fund name - Mandatory | Superannuation fund name | Vanguard Superfund | Super Fund ID (USI) - Mandatory | Unique Superannuation Identifier for the fund | Super fund test | ABN - Mandatory | Valid Australian Business Number of the fund | 65714394898 | | SMSF | | | Type - Mandatory | Type of SuperFund | Accepted values: SMSF | | Employee/member number | Unique Member number for the super fund | 98002 | Fund name - Mandatory | Superannuation fund name | SMSF Family fund | | Electronic Service Address | Electronic Service Address for data messages | ESUPERFUND | ABN - Mandatory | Valid Australian Business Number of the fund | 88714394999 | Bank Account Name - Mandatory | Bank Account name for SMSF | SMSF Fund name | Bank Account BSB - Mandatory | BSB for SMSF | 016 789 | Bank Account Number – Mandatory | Bank Account number for SMSF | 654587787 | For New Zealand Accounts | | | Status - Mandatory | The Kiwi Saver status | Accepted values - ACTIVE, OPT_OUT,

SAVINGS_SUSPENSION, NOT_A_MEMBER | | Employer Contribution Percentage | Kiwi Super contribution made by the employer | 4% | | Employee Contribution Percentage | Kiwi Super contribution made by the employee | 3% (allowed values 3, 4, 6, 8, 10) | | ESCT | Employer Contribution tax based on earnings | 17.5% (allowed values: 10.5, 17.5, 30, 33) | When Kiwi saver status is OPT_OUT | | | | Opt Out Date | Opt out Date | 2022-10-29 | | Bank Account Number | Bank account number when chosen to opt out | 231235435345 | | Account holder's Name | Name of the bank account holder when chosen to opt out | Suresh Rana | | Suspension End Date | Suspension End date | 2021-12-01 | When Kiwi saver status is SAVINGS_SUSPENSION | | | | Suspension End date | Date when the Kiwi saver to be suspended | 2023-09-23 |

|

Australian Accounts

New Zealand Accounts

When status is active:

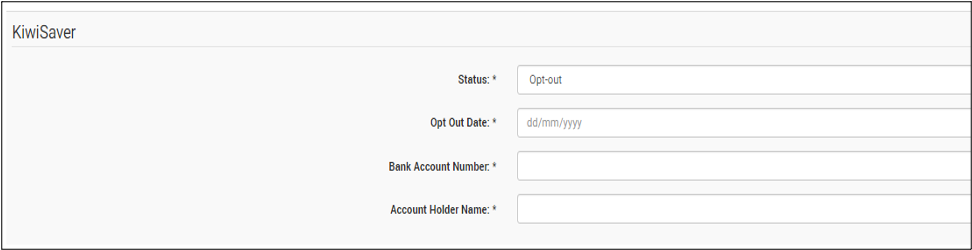

When Status is Opt-out:

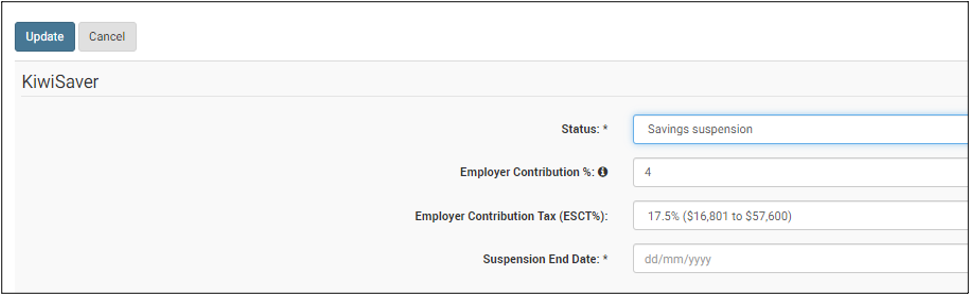

When Status is Suspended:

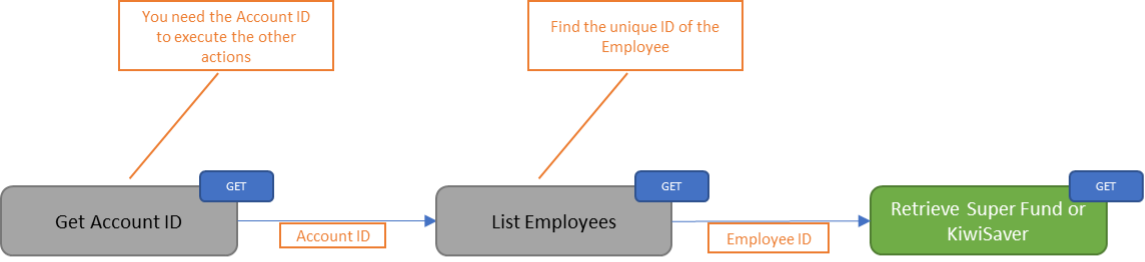

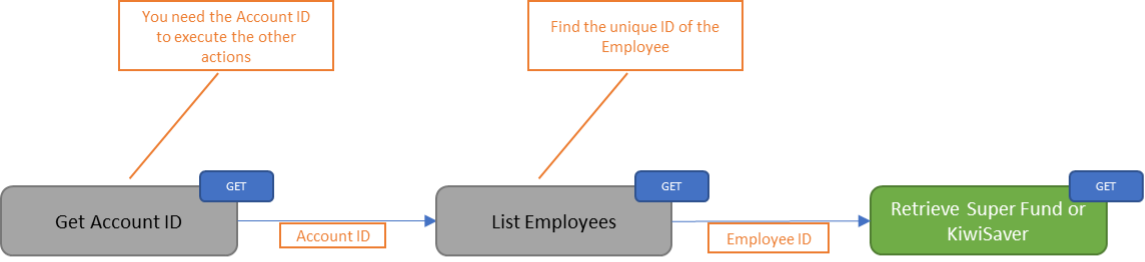

Retrieve Superannuation / Kiwisaver

Use this action to retrieve the details of Superannuation (Australia) or Kiwisaver (New Zealand) of an Employee.

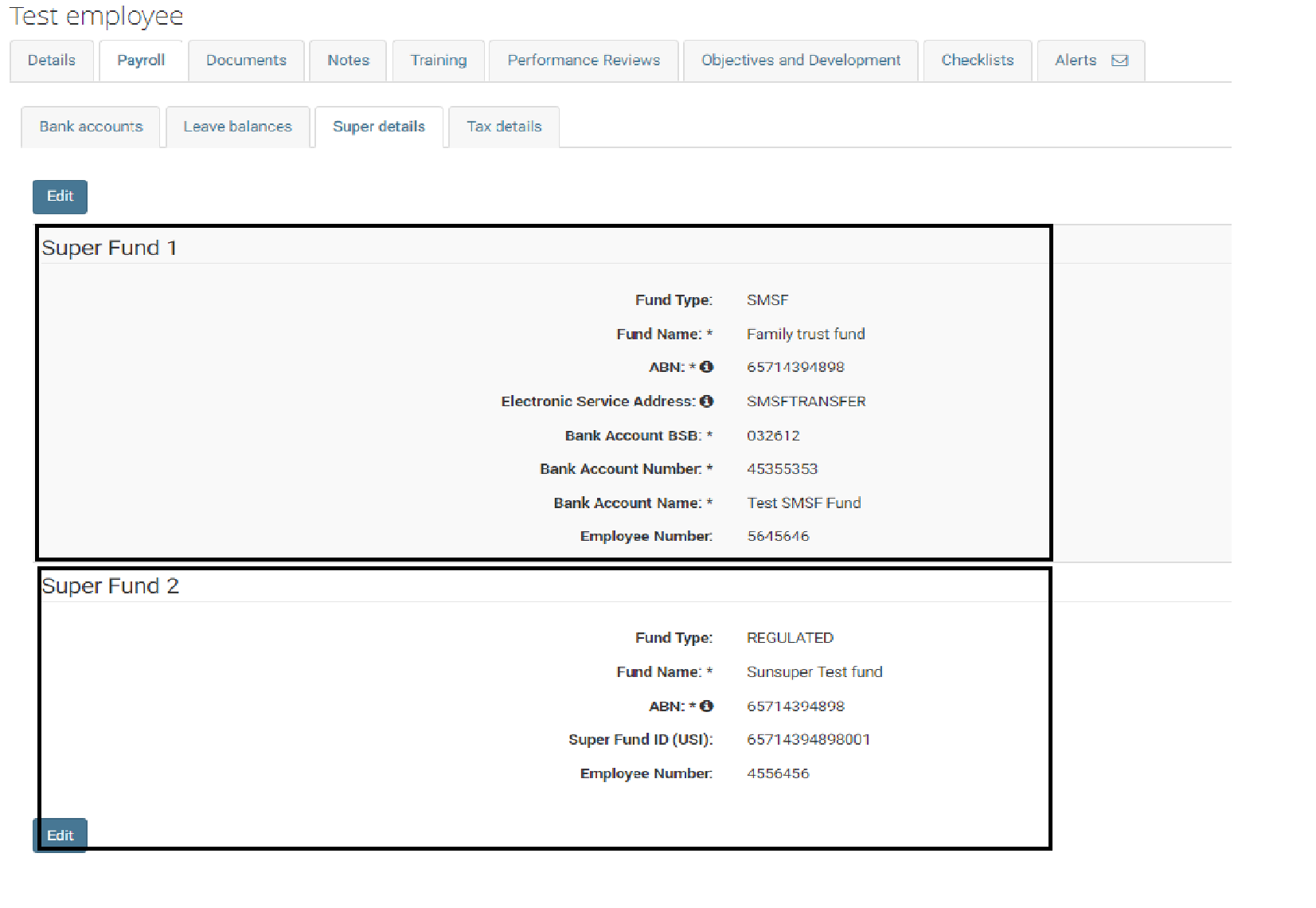

enableHR supports up to 4 super funds in Australia that can include either Regulated or Self-Managed Super Fund types. Multiple Superannuation records can be maintained for an employee including Fund name, Fund address, Fund ABN and USI.

| |

|---|

| Method | GET: Retrieve Superannuation / Kiwisaver details |

| Parameters | Account ID - Unique identifier of the Account

Employee ID - Unique identifier of the Employee |

| Response | | | |

|---|

| Field Name on the Screen | Details | Example | For Australian Accounts | | | | Type | Type of SuperFund | REGULATED or SMSF | | Employee/member number | Unique Unique Member number for the super fund | 98001 | | Fund name | Superannuation fund name | Super fund test | | ABN | Valid Australian Business Number of the fund | 65714394898 | | Electronic Service Address | Electronic Service Address for data messages | ESUPERFUND | | Super Fund ID (USI) | Unique Superannuation Identifier for the fund | STA0100AU | | Bank Account Name | Bank Account name for SMSF | SMSF Fund name | | Bank Account BSB | BSB for SMSF | 016 789 | | Bank Account Number | Bank Account number for SMSF | 654587787 | For New Zealand Accounts | | | | Status | The Kiwi Saver status | Accepted values - ACTIVE, OPT_OUT,

SAVINGS_SUSPENSION, NOT_A_MEMBER | | Employer Contribution Percentage | Kiwi Super contribution made by the employer | 4% | | Employee Contribution Percentage | Kiwi Super contribution made by the employee | 3% (allowed values 3, 4, 6, 8, 10) | | ESCT | Employer Contribution tax based on earnings | 17.5% (allowed values: 10.5, 17.5, 30, 33) |

|

Australian Accounts

New Zealand Accounts

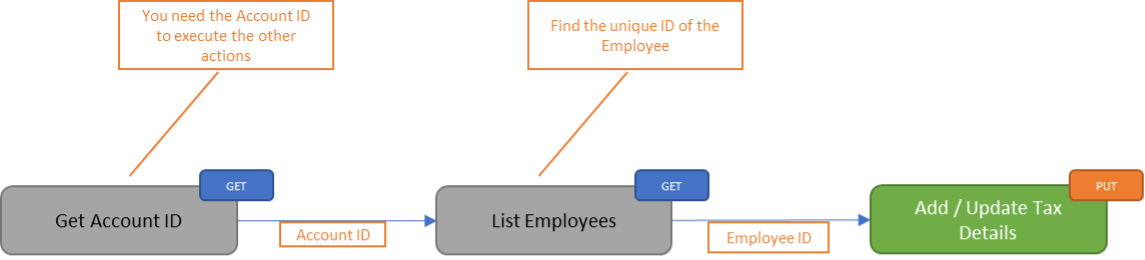

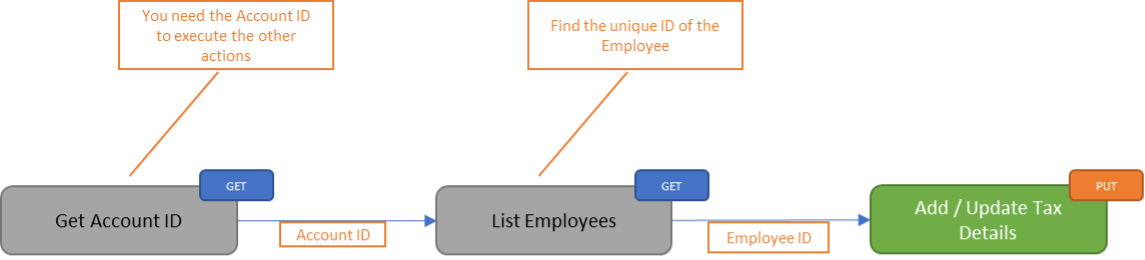

Add / Update Tax Details

Use this action to Add or Update the Tax details of an Employee.

The same action is used to add or update the Tax details in Australia and New Zealand. The API call knows if the Account is in Australia or New Zealand, so you don’t have to specify it.

If the tax details already exist, it will be updated with the new input details otherwise it will be created.

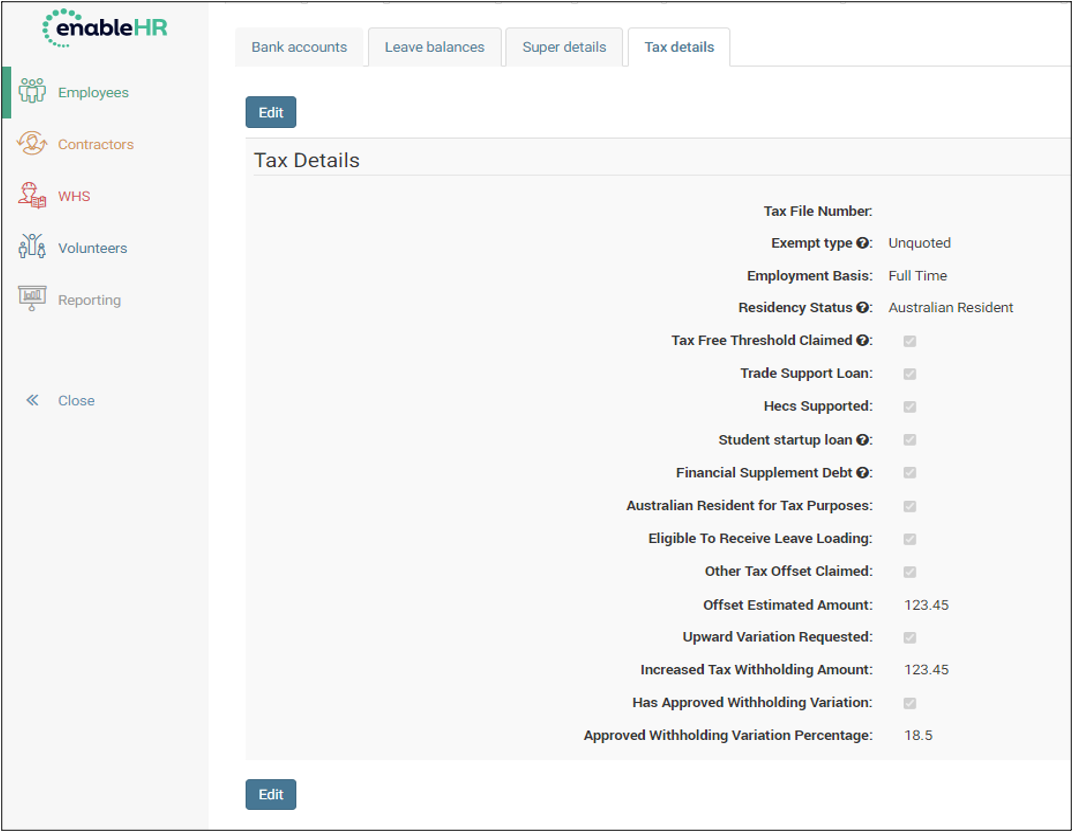

All the essential details needed for the Australian taxation purpose are supported, including Tax File Number, Residency Status, Employment basis, Tax free threshold, HECS and Trade Support Loan.

TFN is always masked except for the last 3 digits (###-###-123), if un-masked TFN is needed for Payroll integration purposes, please contact Client Success.

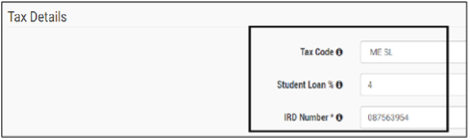

In New Zealand, all mandatory tax information including Tax Code, Student loan percentage and IRD number are maintained in enableHR.

| |

|---|

| Method | PUT: Add/Update Tax Details |

| Parameters | Account ID - Unique identifier of the Account

Employee ID - Unique identifier of the Employee |

| Accepted Fields | | | |

|---|

| Field | Details | Example | For Australian Accounts | | | TFN - Mandatory | Tax file number of an employee | Valid 9 digits of the TFN as enableHR does validations. | | Exempt Type | Any tax exemption based on age | Possible values – Unquoted, Pending, Under 18, Pensioner | | Employee Basis | Type of Employment | Possible values – Full Time, Part Time, Casual, Labor Hire, Super Income stream | | Residency Status | Residency for tax purposes | Possible values – Australian Resident, Foreign Resident, Working Holiday Maker | | Tax Free Threshold Claimed | Employees option whether to be taxed for every dollar earned or not | True / False | | Trade Support Loan | Support for apprentices to assist with everyday costs | True / False | | Hecs Supported | Higher Education Support from Australian government | True / False | | Student startup loan | Voluntary loan for eligible students who get youth allowance | True / False | | Financial Supplement Debt | Financing scheme offered by the Australian government's Social Security office | True / False | | FinAustralian Resident | Australian Resident for Tax Purposes | True / False | | Eligible To Receive Leave Loading | As outlined in your employee's award or workplace agreement | True / False | | Other Tax Offset Claimed | Reduces the tax on the taxable income for Low- and Middle-income earner | True / False | | Upward Variation Requested | Employees request to increase the PAYG deducted from their pay each week or fortnight to avoid a bill from the ATO | True / False | | Approved Withholding Variation | Employees have necessary approval from ATO for withholding variation | True / False | | Approved Withholding Variation Percentage | Percentage value for the withholding variation | 15% | | Income Type | Employment Income | Possible values – Salary and Wages, Closely held payees, Working holiday maker | | Employee's country of Origin | Country of Origin when the employee is a foreigner | AR - Argentina

Valid ISO 3166-1 alpha-2 country code, e.g. "AU", "NZ", "CA", or an empty string ("") to unset a previously set value. ISO 3166-1 alpha-2 | | Tax File Declaration signed | Date when the employee signed TFN declaration | 2001-02-01 | | Tax Scale type | Employee Tax Scale | Possible Values: Regular, Horticulturists and shearers, 'Actors, variety artists and other entertainers', Seniors and pensioners, Working holiday maker, Foreigner | | Employee's working condition | When 'Tax Scale Type' selected is ‘Actors, variety artists and other entertainers' | Possible Values: Promotional, 3 or less performances per week, None of these | | Senior's Marital Status | When 'Tax Scale Type' selected is 'Seniors and pensioners' | Possible Values: Couple, Illness Seperated Couple, Single | | Study and Training Support Loan | Loans taken from Government for higher education, trade apprenticeships and other training programs. | True / False | For New Zealand Accounts | | | Tax Code - Mandatory | Tax codes help the employer work out how much tax to deduct | Allowed values as per the IRD Spec: (CAE, M, M_SL, ME, ME_SL, ND, NSW, S, S_SL, SA, SA_SL, SB, SB_SL, SH, SH_SL, ST, ST_SL, STC, WT) | | IRD Number | Unique number issued by Inland Revenue to customers | 8 or 9-digit number | | Student Loan | Percentage value | 4% |

|

Australian Accounts

New Zealand Accounts

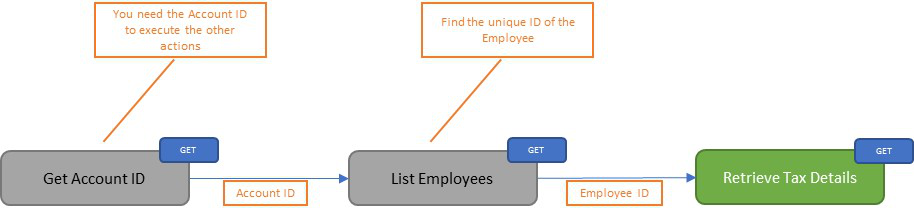

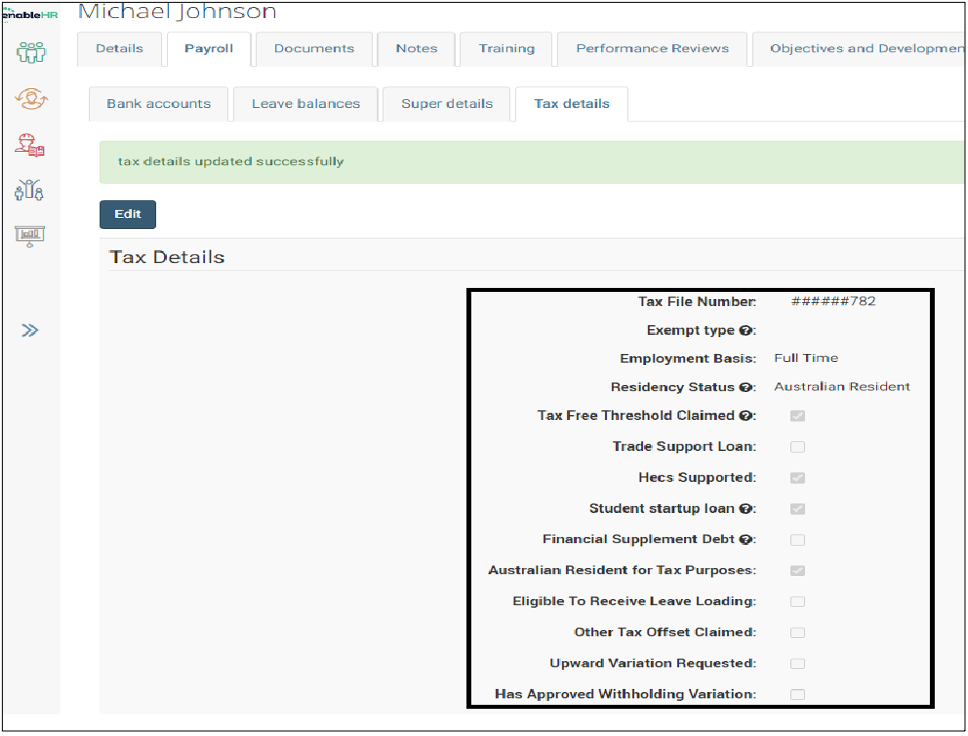

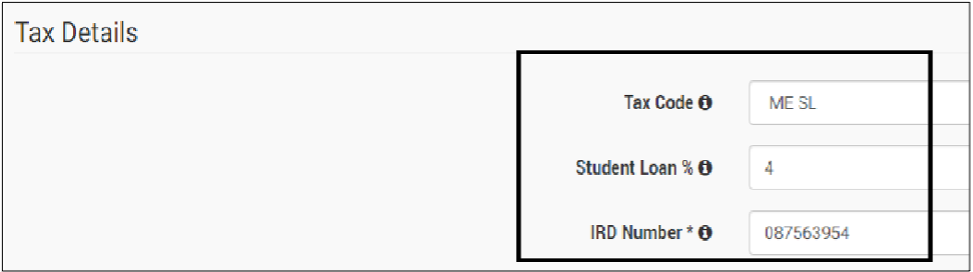

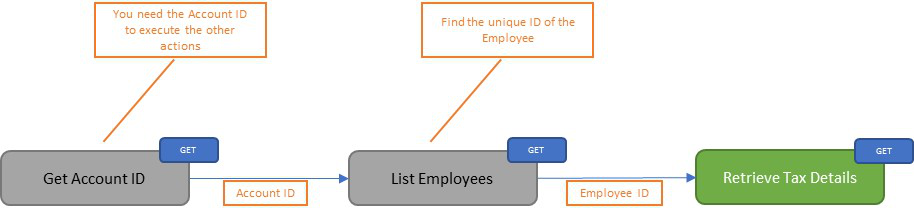

Retrieve Tax Details

Use this action to Add or Update the Tax details of an Employee.

All the essential details needed for the Australian taxation purpose are supported, including Tax File Number, Residency Status, Employment basis, Tax free threshold, HECS and Trade Support Loan.

TFN is always masked except for the last 3 digits (###-###-123), if un-masked TFN is needed for Payroll integration purposes, please contact Client Success.

In New Zealand, all mandatory tax information including Tax Code, Student loan percentage and IRD number are maintained in enableHR.

| |

|---|

| Method | GET: Retrieve tax Details of an Employee |

| Parameters | Account ID - Unique identifier of the Account

Employee ID - Unique identifier of the Employee |

| Response | | | |

|---|

| Field | Details | Example | For Australian Accounts | | | | TFN | Tax file number of an employee | Masked values except for last 3 digits ######782.

Unmasked TFN can be provided to the payroll providers which needs additional security checks. | | Exempt Type | Any tax exemption based on age | Possible values – Unquoted, Pending, Under 18, Pensioner | | Employee Basis | Type of Employment | Possible values – Full Time, Part Time, Casual, Labor Hire, Super Income stream | | Residency Status | Residency for tax purposes | Possible values – Australian Resident, Foreign Resident, Working Holiday Maker | | Tax Free Threshold Claimed | Employees option whether to be taxed for every dollar earned or not | True / False | | Trade Support Loan | Support for apprentices to assist with everyday costs | True / False | | Hecs Supported | Higher Education Support from Australian government | True / False | | Student startup loan | Voluntary loan for eligible students who get youth allowance | True / False | | Financial Supplement Debt | Financing scheme offered by the Australian government's Social Security office | True / False | | FinAustralian Resident | Australian Resident for Tax Purposes | True / False | | Eligible To Receive Leave Loading | As outlined in your employee's award or workplace agreement | True / False | | Other Tax Offset Claimed | Reduces the tax on the taxable income for Low- and Middle-income earner | True / False | | Upward Variation Requested | Employees request to increase the PAYG deducted from their pay each week or fortnight to avoid a bill from the ATO | True / False | | Approved Withholding Variation | Employees have necessary approval from ATO for withholding variation | True / False | | Approved Withholding Variation Percentage | Percentage value for the withholding variation | 15% | | Income Type | Employment Income | Possible values – Salary and Wages, Closely held payees, Working holiday maker | | Employee's country of Origin | Country of Origin when the employee is a foreigner | AR - Argentina

Valid ISO 3166-1 alpha-2 country code, e.g. "AU", "NZ", "CA", or an empty string ("") to unset a previously set value. ISO 3166-1 alpha-2 | | Tax File Declaration signed | Date when the employee signed TFN declaration | 2001-02-01 | | Tax Scale type | Employee Tax Scale | Possible Values: Regular, Horticulturists and shearers, 'Actors, variety artists and other entertainers', Seniors and pensioners, Working holiday maker, Foreigner | | Employee's working condition | When 'Tax Scale Type' selected is 'Actors, variety artists and other entertainers' | Possible Values: Promotional, 3 or less performances per week, None of these | | Senior's Marital Status | When 'Tax Scale Type' selected is 'Seniors and pensioners' | Possible Values: Couple, Illness Seperated Couple, Single | | Study and Training Support Loan | Loans taken from Government for higher education, trade apprenticeships and other training programs. | True / False | For New Zealand Accounts | | | | Tax Code | Tax codes help the employer work out how much tax to deduct | Allowed values as per the IRD Spec: (CAE, M, M_SL, ME, ME_SL, ND, NSW, S, S_SL, SA, SA_SL, SB, SB_SL, SH, SH_SL, ST, ST_SL, STC, WT) | | IRD Number | Unique number issued by Inland Revenue to customers | 8 or 9-digit number | | Student Loan | Percentage value | 4% |

|

Australian Accounts

New Zealand Accounts

Leave Balances

Although enableHR doesn’t provide Leave Management feature, it stores Leave Balances so that managers and employees can visualise them.

In Australia, the following leave types are currently supported:

- Annual Leave

- Personal Leave

- Long Service Leave

In New Zealand, the following leave types are currently supported:

- Annual Leave

- Sick Leave

- Long Service Leave

- Domestic Violence leave

- Bereavement leave

- Parental leave

- Alternative Holidays

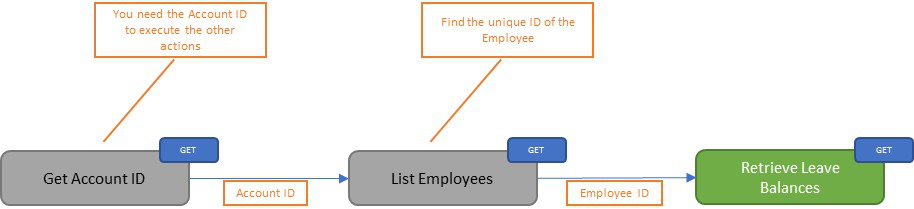

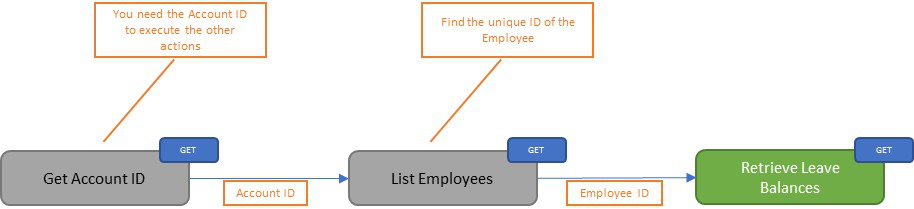

Retrieve Leave Balances

Use this action to retrieve the Leave Balances of an Employee.

In Australia, the following leave types are currently supported: Annual Leave, Personal Leave, Long Service Leave.

In New Zealand, the following leave types are currently supported: Annual Leave, Sick Leave, Long Service Leave, Domestic Violence leave, Bereavement leave, Parental leave, Alternative Holidays.

Units can be in days or hours as maintained by client.

| |

|---|

| Method | GET: Retrieve Employee Leave balances |

| Parameters | Account ID - Unique identifier of the Account

Employee ID - Unique identifier of the Employee |

| Response | | | |

|---|

| Field | Details | Example | For Australian Accounts | | | | Annual Leave | Annual leave units stored in enableHR for the employee | 480.23 | | Personal Leave | Personal leave units | 220.00 | | Long Service Leave | Long Service leave units | 13.00 | | | | For New Zealand Accounts | | | | Annual Leave | Annual leave units stored in enableHR for the employee | 23.42 | | Sick Leave | Sick leave units | 12.32 | | Long Service Leave | Long Service leave units | 0 | | Domestic Violence leave | Domestic Violence leave units | 0 | | Bereavement leave | Bereavement leave units provided to employee | 16.0 | | Parental leave | Parental leave units provided to employee | 0 | | Alternative Holidays | Any alternative leave provided to employee | 0 |

|

Australian Accounts

New Zealand Accounts

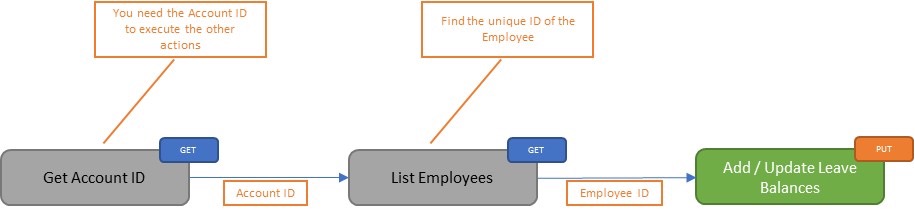

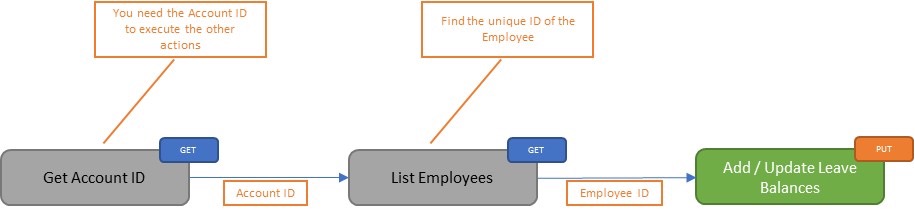

Update Leave Balances

Use this action to add or update Leave Balances of an Employee.

The same action is used to add or update the Leave Balances in Australia and New Zealand. The API call knows if the Account is in Australia or New Zealand, so you don’t have to specify it.

In Australia, the following leave types are currently supported: Annual Leave, Personal Leave, Long Service Leave.

In New Zealand, the following leave types are currently supported: Annual Leave, Sick Leave, Long Service Leave, Domestic Violence leave, Bereavement leave, Parental leave, Alternative Holidays.

Units can be in days or hours as maintained by client.

| |

|---|

| Method | PUT: Maintain Leave Balances |

| Parameters | Account ID - Unique identifier of the Account

Employee ID - Unique identifier of the Employee |

| Accepted Fields | | | |

|---|

| Field | Details | Example | For Australian Accounts | | | | Annual Leave | Annual leave units stored in enableHR for the employee | 480.23 | | Personal Leave | Personal leave units | 220.00 | | Long Service Leave | Long Service leave units | 13.00 | | | | For New Zealand Accounts | | | | Annual Leave | Annual leave units stored in enableHR for the employee | 23.42 | | Sick Leave | Sick leave units | 12.32 | | Long Service Leave | Long Service leave units | 0 | | Domestic Violence leave | Domestic Violence leave units | 0 | | Bereavement leave | Bereavement leave units provided to employee | 16.0 | | Parental leave | Parental leave units provided to employee | 0 | | Alternative Holidays | Any alternative leave provided to employee | 0 |

|

Australian Accounts

New Zealand Accounts

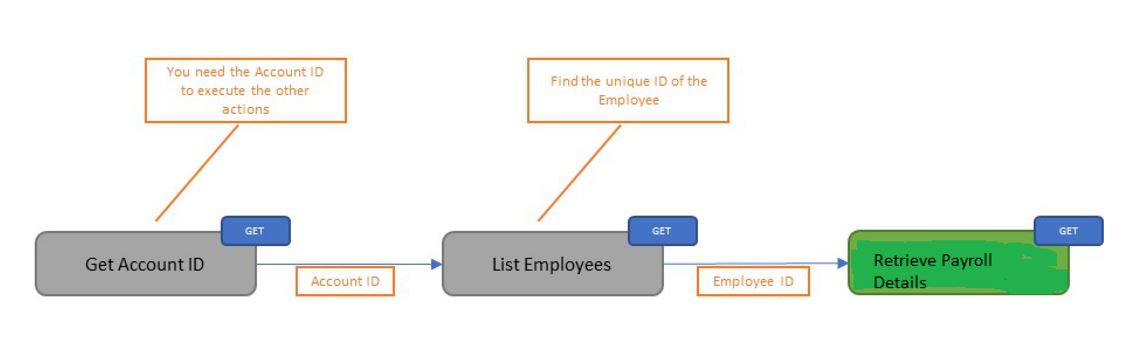

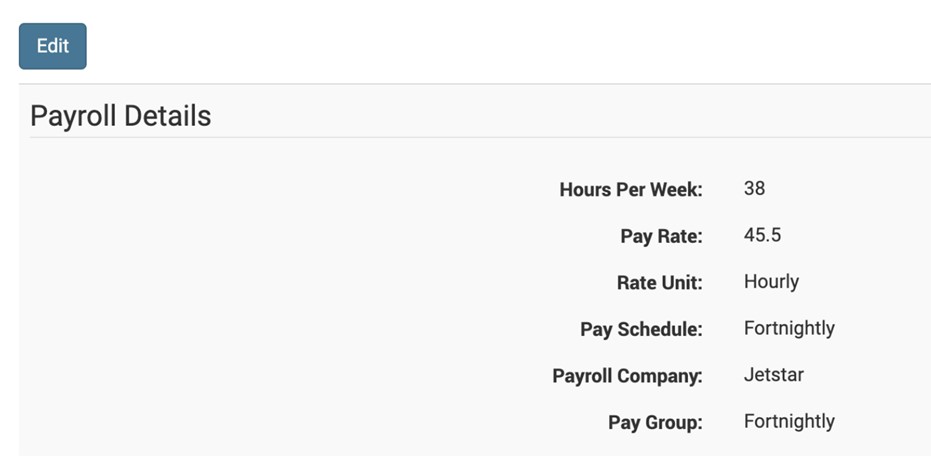

Retrieve Payroll Details

Use this action to retrieve payroll details of an Employee.

Payroll details are very much common elements to be used for Payroll processing both in Australia and New Zealand.

Hours Per Week, Pay Rate, Rate Unit, Pay Schedule, Payroll Company and Pay Group are the fields available through this end point.

| |

|---|

| Method | GET: Retrieve Employee Payroll Details |

| Parameters | Account ID - Unique identifier of the Account

Employee ID - Unique identifier of the Employee |

| Response | | | |

|---|

| Field | Details | Example | For Australian & New Zealand Accounts | | | | Hours Per Week | Standard hours employee supposed to work in a week. | 40 | | Pay Rate | Pay Rate at which an employee is by an hour/year. | 42.14 | | Rate Unit | Rate to choose if its by hourly/annually. | Possible Values - Hourly, Annually | | Pay Schedule | Frequency at which employee is paid. | Possible Values - Weekly, Fortnightly, Monthly, Twice_Monthly | | Payroll Company | Free text to use for payroll processing | Indigo Australia | | Pay Group | Free text to use for payroll processing | Fortnight hourly emps |

|

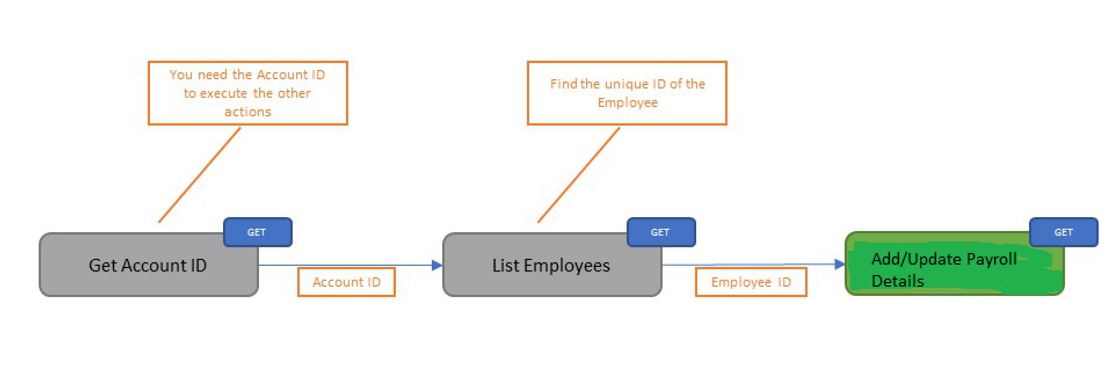

Add/Update Payroll Details

Use this action to maintain payroll details of an Employee.

Payroll details are very much common elements to be used for Payroll processing both in Australia and New Zealand.

Hours Per Week, Pay Rate, Rate Unit, Pay Schedule, Payroll Company and Pay Group are the fields available for maintenance through this end point.

| |

|---|

| Method | PUT: Maintain Employee Payroll Details |

| Parameters | Account ID - Unique identifier of the Account

Employee ID - Unique identifier of the Employee |

| Response | | | |

|---|

| Field | Details | Example | For Australian & New Zealand Accounts | | | | Hours Per Week | Standard hours employee supposed to work in a week. | 40 | | Pay Rate | Pay Rate at which an employee is by an hour/year. | 42.14 | | Rate Unit | Rate to choose if its by hourly/annually. | Possible Values - Hourly, Annually | | Pay Schedule | Frequency at which employee is paid. | Possible Values - Weekly, Fortnightly, Monthly, Twice_Monthly | | Payroll Company | Free text to use for payroll processing | Indigo Australia | | Pay Group | Free text to use for payroll processing | Fortnight hourly emps |

|